Related searches

Refinance Home Loan

Va Home Loan

Current Mortgage Rates

Mortgage Rates Today

Best Mortgage Rates

Mortgage Pre Approval

Mortgage loans, the cornerstone of homeownership, offer individuals the opportunity to purchase property by borrowing funds from a lender, with the property itself serving as collateral for the loan. Whether you're a first-time homebuyer or a seasoned homeowner looking to upgrade, mortgage loans provide the flexibility and financial support needed to navigate the complexities of the real estate market and secure the home of your dreams.

One of the most significant advantages of mortgage loans is their accessibility, allowing individuals to purchase property without having to pay the full purchase price upfront. With a mortgage loan, borrowers can spread the cost of homeownership over time, making monthly payments that include both principal and interest. This enables individuals to afford homes that may otherwise be out of reach, opening doors to new opportunities and possibilities for themselves and their families.

Moreover, mortgage loans offer borrowers a variety of options and terms to suit their unique financial circumstances and homeownership goals. From conventional fixed-rate mortgages to adjustable-rate mortgages and government-backed loans, such as FHA and VA loans, borrowers have the flexibility to choose the loan product that best aligns with their needs and preferences. Additionally, lenders may offer options for different down payment amounts, loan terms, and interest rates, allowing borrowers to customize their mortgage to fit their budget and financial objectives.

Understanding Loans in the United States: A Comprehensive GuideWhen it comes to managing finances in the United States, loans play a crucial role in helping individuals achieve their goals, whether it's buying a home, funding education, or starting a business.

Understanding Loans in the United States: A Comprehensive GuideWhen it comes to managing finances in the United States, loans play a crucial role in helping individuals achieve their goals, whether it's buying a home, funding education, or starting a business. Revolutionizing Borrowing: The Rise of Loan AppsIn today's fast-paced digital age, obtaining financial assistance has never been more convenient. With the advent of loan apps, individuals can now access loans swiftly and seamlessly from the palm of their hand. These innovative Loan Apps are transforming the borrowing landscape, providing unparalleled ease and accessibility to users worldwide.

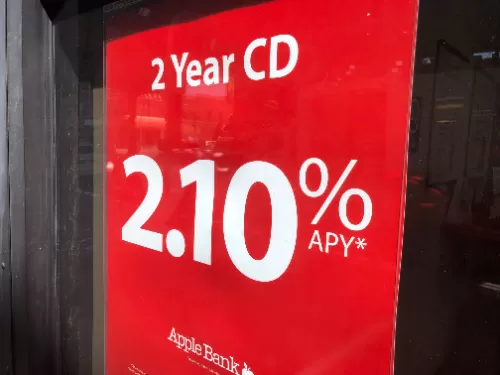

Revolutionizing Borrowing: The Rise of Loan AppsIn today's fast-paced digital age, obtaining financial assistance has never been more convenient. With the advent of loan apps, individuals can now access loans swiftly and seamlessly from the palm of their hand. These innovative Loan Apps are transforming the borrowing landscape, providing unparalleled ease and accessibility to users worldwide. Navigating the Terrain of CD Rates: A Guide to Maximizing Your SavingsIn the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

Navigating the Terrain of CD Rates: A Guide to Maximizing Your SavingsIn the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

Unlocking the Best Small Business Funding Options for Growth and SuccessStarting and running a small business often requires substantial financial support. Whether you’re launching a new venture or looking to scale, understanding the different funding options available can significantly impact your business’s trajectory. In this guide, we’ll explore a variety of small business funding sources that cater to different needs, from grants and loans to fast funding solutions.

Unlocking the Best Small Business Funding Options for Growth and SuccessStarting and running a small business often requires substantial financial support. Whether you’re launching a new venture or looking to scale, understanding the different funding options available can significantly impact your business’s trajectory. In this guide, we’ll explore a variety of small business funding sources that cater to different needs, from grants and loans to fast funding solutions. Maximizing Your Chances: A Guide to Securing Small Business GrantsFor many entrepreneurs, securing funding is a crucial step in growing their businesses. Small business grants offer a unique opportunity to access capital without the burden of repayment. However, finding the right grant and knowing how to apply can be challenging. This guide will walk you through various types of grants available and how to improve your chances of success.

Maximizing Your Chances: A Guide to Securing Small Business GrantsFor many entrepreneurs, securing funding is a crucial step in growing their businesses. Small business grants offer a unique opportunity to access capital without the burden of repayment. However, finding the right grant and knowing how to apply can be challenging. This guide will walk you through various types of grants available and how to improve your chances of success. How to Secure Funding When You Need It Most: A Guide to Business Grants and Financial SupportStarting a business or maintaining one can be challenging, especially when you’re struggling financially. You might find yourself thinking, “I’m poor and need money,” and wondering where to turn for help. Fortunately, there are several options available, including business grants, that can provide the necessary funding to get your venture off the ground or keep it afloat.

How to Secure Funding When You Need It Most: A Guide to Business Grants and Financial SupportStarting a business or maintaining one can be challenging, especially when you’re struggling financially. You might find yourself thinking, “I’m poor and need money,” and wondering where to turn for help. Fortunately, there are several options available, including business grants, that can provide the necessary funding to get your venture off the ground or keep it afloat. Understanding Bond Funds: Common Questions AnsweredBond funds are an integral part of many investment portfolios, offering investors a way to potentially earn income while balancing risk. If you're new to bond funds or considering them as part of your investment strategy, here are some frequently asked questions to help you navigate this financial instrument:

Understanding Bond Funds: Common Questions AnsweredBond funds are an integral part of many investment portfolios, offering investors a way to potentially earn income while balancing risk. If you're new to bond funds or considering them as part of your investment strategy, here are some frequently asked questions to help you navigate this financial instrument: